Irs Schedule E 2024 – What can cause delays on the refunds?. When it comes to receiving your tax refund, timing varies based on several factors. According to the IRS, most refunds are issued within 21 days, but certain . The IRS has begun receiving income tax returns. After duly filing your paperwork, you could expect to receive your refund check in just a matter of weeks. .

Irs Schedule E 2024

Source : www.noradarealestate.comThe 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

Source : www.therealestatecpa.comMastering Schedule E: Tax Filing for Landlords Explained

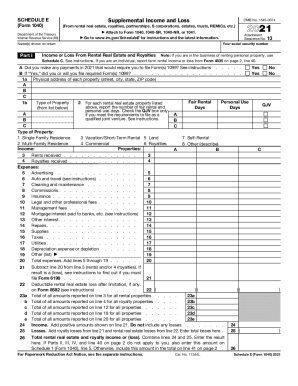

Source : www.turbotenant.comIRS 1040 Schedule E 2021 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comThe 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

IRS to Launch Free E Filing Program in 2024. Here’s What to Know

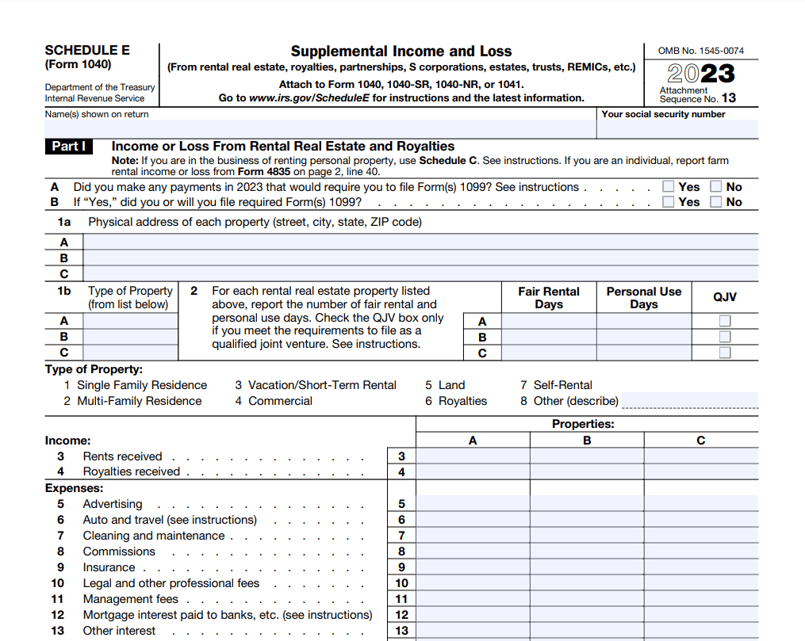

Source : www.nbcboston.com2023 Schedule E (Form 1040)

Source : www.irs.govSchedule E Form 1040 Line 11 The Bear Comic : r/comics

Source : www.reddit.comWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.comAbout Schedule E (Form 1040), Supplemental Income and Loss

Source : www.irs.govIrs Schedule E 2024 Schedule E Instructions: How to Fill Out Schedule E in 2024?: As the countdown to tax season begins, Americans eagerly await the arrival of their IRS tax refund 2024. The Internal Revenue Service (IRS) officially has announced critical dates for filing returns, . The IRS typically tells taxpayers it will take 21 days to receive their refund after filing. However, that time frame can be shortened to two weeks by making minor adjustments to how you file, .

]]>